Ripple Price: The Best Powerful Comprehensive Guide

Introduction to Ripple (XRP)

Ripple Price, commonly known as XRP, facilitates fast and cost-effective cross-border transactions with its digital currency design. As one of the most popular cryptocurrencies in the market, XRP has captured the attention of both institutional and retail investors. Unlike other cryptocurrencies such as Bitcoin (BTC) or Ethereum (ETH), which primarily focus on decentralization and store of value, XRP aims to revolutionize the global payment system. In this article, we dive deep into the price trends of Ripple (XRP), analyze its historical performance, and discuss factors that may influence its future price movements.

What is Ripple (XRP)?

Ripple is more than just a cryptocurrency; A payment protocol is designed to facilitate fast and secure cross-border transactions. Launched in 2012, Ripple’s blockchain-based platform offers a real-time ross settlement system (RTGS), currency exchange, and remittance network. Its native token, XRP, acts as a bridge currency for financial institutions, ensuring liquidity and reducing transaction fees.

XRP is primarily used by RippleNet, the payment network, for processing cross-border payments. This network, supported by large financial institutions, makes XRP a powerful contender in the global financial system. The primary goal of Ripple is to streamline cross-border payments, a sector currently dominated by slow and expensive traditional systems such as SWIFT.

Ripple’s Unique Consensus Algorithm

Unlike Bitcoin and Ethereum, which use Proof of Work (PoW) and Proof of Stake (PoS) respectively, Ripple employs a unique Consensus Ledger to validate transactions. This algorithm allows for processing transactions in just 3-5 seconds, with significantly lower fees than its competitors. As a result, it is faster and more energy-efficient.

The Difference Between Ripple and XRP

While “Ripple” refers to the company behind the technology, “XRP” is the digital currency used within Ripple’s payment protocol. It is essential to distinguish between the two, as the company’s success does not necessarily correlate with XRP’s price performance, though they are closely linked.

Historical Price Analysis of XRP

XRP’s Early Years (2013 – 2017)

When Ripple first launched XRP in 2012, it was trading at a mere fraction of a cent. For a few years, the price remained relatively stable, hovering around $0.005. However, by 2017, with the overall rise of cryptocurrencies, XRP saw a significant price surge, reaching an all-time high of $3.84 in January 2018. The broader cryptocurrency market rally and growing institutional interest in Ripple’s payment solutions drove this monumental rise in Ripple.

The Crypto Market Correction (2018 – 2019)

The cryptocurrency market underwent a massive correction in 2018, and XRP was not immune to this downturn. After reaching its peak in early 2018, XRP’s price declined sharply. By the end of 2018, it was trading around $0.30. Despite the downturn, Ripple continued to expand its partnerships with financial institutions, which helped provide some stability to XRP’s price. However, the price remained relatively stagnant for much of 2019.

The Legal Battle with the SEC (2020 – 2021)

One of the most significant events in XRP’s history was the SEC lawsuit against Ripple Labs in December 2020. The selling of XRP by Ripple, according to the SEC, was an unlicensed securities offering. This legal battle sent shockwaves through the market, causing XRP’s price to plummet by more than 50% in a matter of days, from around $0.60 to $0.25.

Despite the legal uncertainty, XRP managed to recover in 2021, buoyed by a broader market rally and growing optimism that Ripple would prevail in its legal case. By April 2021, XRP was trading at over $1, reaching a yearly high of $1.96 in the same month.

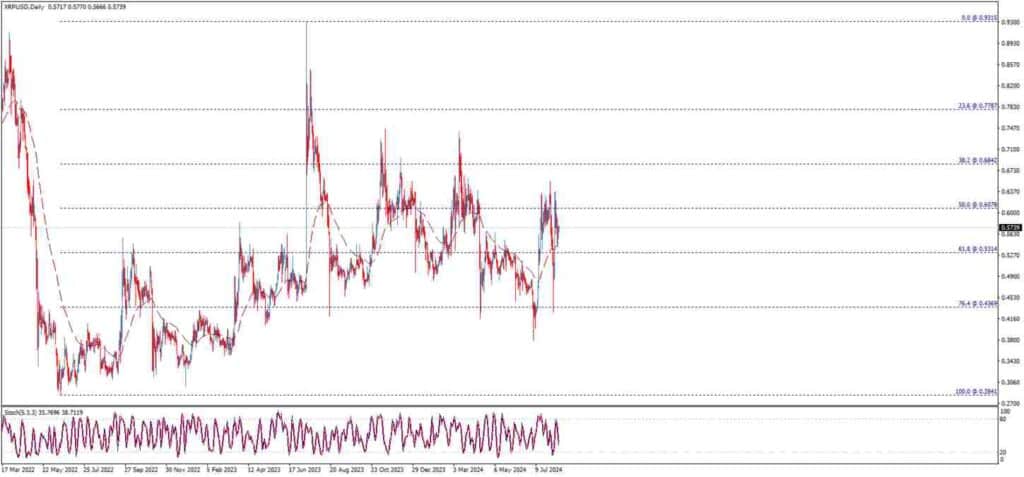

XRP’s Performance in 2022 – 2023

Throughout 2022, XRP’s price remained volatile but relatively stable compared to the dramatic swings of earlier years. Developments in the ongoing SEC lawsuit influenced much of its price movement.

In 2023, Ripple secured partial victories in the case, causing a surge in investor confidence. As of late 2023, XRP is trading in the range of $0.50 to $0.60, with renewed optimism surrounding its future.

Key Factors Influencing XRP’s Price

1. Legal Developments with the SEC

The ongoing SEC lawsuit remains one of the most significant factors affecting XRP’s price. A favorable ruling for Ripple could lead to a massive rally, as it would remove the legal uncertainty hanging over the cryptocurrency. On the other hand, a negative outcome could dampen investor sentiment and cause another major price drop.

2. Adoption by Financial Institutions

Ripple has formed partnerships with over 300 financial institutions worldwide, including major players like Santander and American Express. The more institutions that adopt RippleNet and use XRP for liquidity, the higher the demand for XRP is likely to be. Increased adoption is one of the key drivers of long-term price growth.

3. Market Sentiment and Investor Confidence

Market sentiment influences the price of XRP, like that of all cryptocurrencies. Positive news, such as new partnerships or technological advancements, tends to boost XRP’s price. Conversely, negative news—whether related to the lawsuit or general market downturns—can lead to sharp price declines.

4. Competition from Other Cryptocurrencies

Other cryptocurrencies, including Stellar (XLM), founded by Jed McCaleb, co-founder of Ripple, compete with XRP. Stellar also focuses on cross-border payments, making it a direct competitor to Ripple. Moreover, traditional financial systems such as SWIFT are also evolving to incorporate blockchain technology, potentially posing a threat to Ripple’s long-term dominance.

5. Technological Innovations

Ripple continues to innovate, with projects such as RippleNet’s On-Demand Liquidity (ODL) gaining traction. ODL uses XRP to source liquidity for cross-border transactions, reducing the need for pre-funded accounts. As more financial institutions adopt ODL, the demand for XRP is likely to increase, providing upward pressure on its price.

6. Macroeconomic Factors

Broader economic trends, including inflation, interest rates, and regulatory developments, also influence XRP’s price. In times of economic uncertainty, investors may turn to cryptocurrencies as an alternative asset class, boosting demand for XRP and other digital currencies.

XRP Price Predictions for the Future

Short-Term Outlook (2024 – 2025)

The SEC lawsuit will significantly influence XRP’s price action in the short term. A favorable resolution could see XRP break through resistance levels and surge towards the $1.50 to $2.00 range. However, if Ripple faces setbacks, we could see XRP struggle to maintain its current price levels, with a potential drop below $0.50.

The broader cryptocurrency market will also play a crucial role. If Bitcoin (BTC) and Ethereum (ETH) continue to perform well, XRP is likely to follow suit, as the entire market tends to move in tandem with major cryptocurrencies.

Medium-Term Outlook (2026 – 2028)

Looking further ahead, Ripple’s partnerships with financial institutions and its push for global adoption of RippleNet will be crucial for XRP’s long-term success. As more institutions adopt ODL for liquidity sourcing, demand for XRP could increase significantly. If Ripple manages to capture a sizable share of the global remittance market, XRP could see prices in the range of $3 to $5 by 2028.

Long-Term Outlook (2029 and Beyond)

In the long term, XRP’s price will depend on its ability to maintain relevance in an increasingly competitive market. If Ripple can continue to innovate and expand its network of partners, XRP could potentially reach new all-time highs, surpassing $5 or even $10. However, competition from other payment-focused cryptocurrencies and evolving traditional financial systems will remain a significant challenge.

How to Invest in XRP

Investing in XRP is relatively straightforward. XRP can be purchased on major cryptocurrency exchanges such as Binance, Coinbase, and Kraken. After purchasing XRP, it is advisable to store it in a secure wallet, preferably a hardware wallet like Ledger or Trezor, to protect against potential hacks.

Risks to Consider

Investing in cryptocurrencies is inherently risky, and XRP is no exception. The legal challenges Ripple faces, combined with the volatile nature of the cryptocurrency market, mean that XRP’s price can fluctuate dramatically in a short period. Therefore, it is crucial for investors to conduct thorough research and only invest what they are willing to lose.

Conclusion: Is XRP a Good Investment?

Ripple’s XRP is a unique cryptocurrency with a clear use case in the global financial system. Its partnerships with major financial institutions and ongoing innovations make it a compelling investment opportunity for those looking to diversify their portfolio. However, potential investors must be aware of the risks associated with legal challenges and market volatility.

XRP has demonstrated resilience in the face of adversity, and its future largely depends on the resolution of the SEC lawsuit and its ability to maintain adoption among financial institutions. While there are no guarantees in the world of cryptocurrency, XRP’s potential to revolutionize

Read more: Crypto nft meaning